Getting married is a significant life event, and while it’s a time for celebration, it’s also a good idea to think about the practical aspects of your union. One crucial document to consider is a prenuptial agreement template, which can help you and your partner outline your financial responsibilities and asset distribution in the event of a divorce.

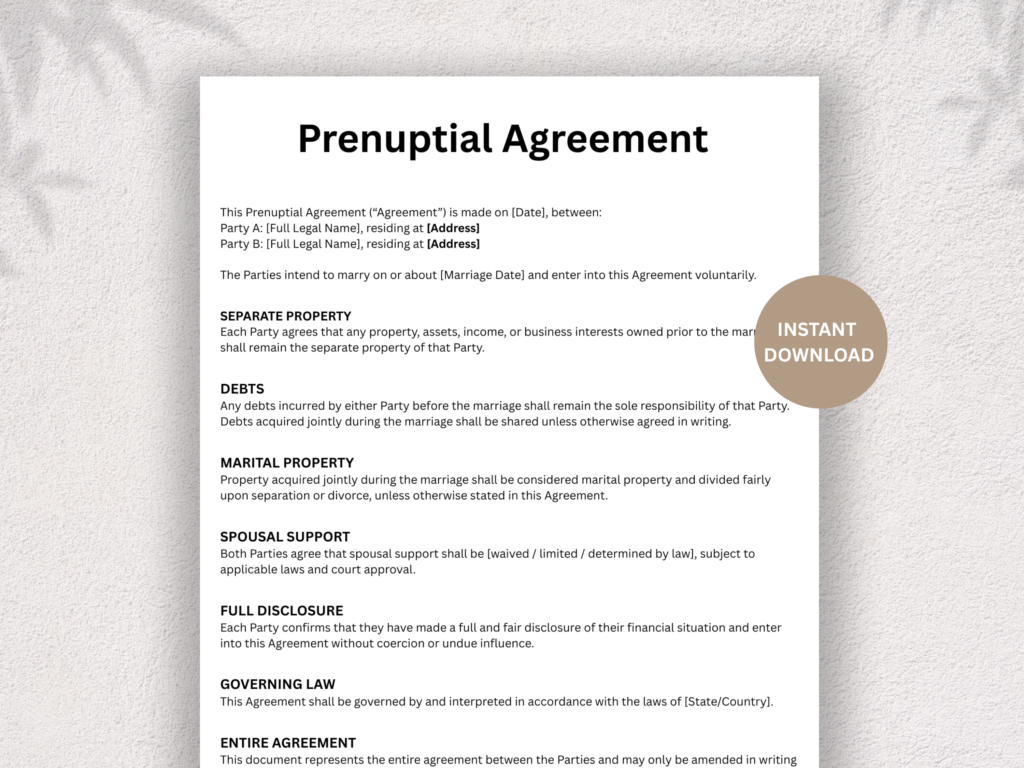

prenuptial agreement template

Having a prenup in place can provide peace of mind and protect your individual and shared assets. It’s a proactive step towards securing your financial future together.

Key Takeaways

- A prenuptial agreement template helps outline financial responsibilities.

- It provides a clear plan for asset distribution in case of divorce.

- Having a prenup can offer peace of mind for couples.

- It’s a proactive step towards securing your financial future.

- A prenuptial agreement can protect individual and shared assets.

Understanding Prenuptial Agreements template

Marriage is not just a union of love but also of financial and legal responsibilities, which is where a prenuptial agreement comes into play. A prenuptial agreement, commonly known as a prenup, is a legally binding contract between two individuals planning to get married.

Definition and Purpose

A prenuptial agreement outlines the division of assets, financial responsibilities, and other matters in the event of a divorce or death. Its primary purpose is to provide clarity and protection for both parties’ financial interests. By having a clear understanding of their financial obligations and rights, couples can avoid potential disputes in the future.

The agreement can cover various aspects, including property division, spousal support, and debt allocation. It serves as a practical tool for couples to manage their financial expectations and responsibilities.

Legal Status in the United States

In the United States, the legal status of prenuptial agreements is governed by state laws, which can vary significantly. Generally, prenuptial agreements are recognized as legally binding contracts if they meet certain requirements, such as being in writing, signed by both parties, and executed voluntarily.

| State | Legal Requirement for Prenuptial Agreements | Enforceability |

| California | Must be in writing and signed by both parties | Generally enforceable |

| New York | Must be in writing, signed, and notarized | Enforceable with certain conditions |

| Texas | Must be in writing and signed by both parties | Enforceable unless proven unconscionable |

Understanding the legal requirements and enforceability of prenuptial agreements in your state is crucial for ensuring that your agreement is valid and effective.

Why You Might Need a Prenuptial Agreement Te

A prenuptial agreement can be a vital tool for protecting your financial future before you tie the knot. This legal document allows couples to make decisions about their financial responsibilities and asset distribution in the event of a divorce or death. By having a clear understanding of what a prenuptial agreement entails, you can better appreciate its value in securing your financial well-being.

Protection of Pre-Marital Assets

One of the primary reasons for creating a prenuptial agreement is to protect the assets you owned before your marriage. This can include property, savings, investments, and other valuable possessions. By specifying how these assets should be treated in the event of a divorce, you can ensure that your pre-marital property remains yours.

Business Ownership Considerations

If you own a business or have a stake in one, a prenuptial agreement can help clarify how the business will be handled if the marriage ends. This can be particularly important for entrepreneurs who want to ensure that their business remains intact. It can prevent potential disputes and protect your business interests.

Debt Protection

Another crucial aspect of a prenuptial agreement is debt protection. If one partner has significant debts, a prenuptial agreement can prevent the other partner from becoming responsible for those debts in the event of a divorce. This can provide peace of mind and financial security.

| Benefits | Description |

| Asset Protection | Protects pre-marital assets and ensures they remain yours |

| Business Protection | Clarifies how a business will be handled in the event of a divorce |

| Debt Protection | Prevents one partner from becoming responsible for the other’s debts |

Who Should Consider a Prenuptial Agreement

Understanding who can benefit from a prenuptial agreement can help couples make informed decisions about their financial future. While these agreements are often associated with wealthier individuals, they can be beneficial for various people.

High Net Worth Individuals

For high net worth individuals, a prenuptial agreement can be particularly valuable. It helps protect their assets in the event of a divorce, ensuring that their wealth is distributed according to their wishes. As “A prenuptial agreement is like an insurance policy for your assets.” – a statement that resonates with many financial advisors.

Business Owners and Entrepreneurs

Business owners and entrepreneurs should also consider prenuptial agreements to safeguard their business interests. By outlining how business assets will be handled in a divorce, they can protect their company’s future. A prenuptial agreement can help prevent potential disputes that might affect business operations.

People Entering Second Marriages

For individuals entering second marriages, a prenuptial agreement can be especially important. It helps clarify financial responsibilities and protect the assets they accumulated during their previous marriage, ensuring a smoother transition into their new life together.

By considering a prenuptial agreement, these individuals can better protect their financial well-being and ensure a clearer understanding of their financial responsibilities within their marriage.

Legal Requirements for a Valid Prenuptial Agreement

A prenuptial agreement’s validity hinges on meeting specific legal requirements, which we’ll explore in this section. Ensuring that these requirements are met is crucial for the agreement to be enforceable in a court of law.

Full Financial Disclosure

Full financial disclosure is a critical component of a valid prenuptial agreement. Both parties must provide a complete and accurate picture of their financial situation, including assets, debts, and income. This transparency helps prevent disputes and ensures that the agreement is fair and reasonable.

prenuptial agreement legal requirements

Voluntary Execution

The prenuptial agreement must be executed voluntarily by both parties. This means that neither party should be coerced or pressured into signing the agreement. It’s essential that both individuals have the opportunity to review the agreement thoroughly and seek independent legal counsel if desired.

Timing Considerations

Timing is also a critical factor in the validity of a prenuptial agreement. The agreement should be signed well in advance of the wedding date to avoid claims of duress or coercion. Signing the agreement too close to the wedding date can lead to disputes about its validity.

In conclusion, meeting the legal requirements for a valid prenuptial agreement is essential for its enforceability. By ensuring full financial disclosure, voluntary execution, and appropriate timing, couples can create a fair and reasonable agreement that protects their interests.

Essential Prenuptial Agreement Template Components

When creating a prenuptial agreement, it’s essential to include several key components to ensure the document is comprehensive and legally binding. A well-structured prenuptial agreement template serves as a foundation for a fair and transparent understanding between spouses regarding their financial rights and responsibilities.

Identification and Declaration Section

The prenuptial agreement should begin with an identification section that clearly states the names of the parties involved and their intention to marry. This section should also include a declaration that both parties are entering into the agreement voluntarily.

Property and Asset Division

Property division is a critical aspect of any prenuptial agreement. This section should outline how assets will be divided in the event of a divorce or separation.

Separate Property Provisions

Separate property provisions should clearly define what constitutes separate property, such as assets owned before the marriage or acquired through inheritance.

Marital Property Provisions

Marital property provisions, on the other hand, should outline how jointly acquired assets will be divided.

Debt Allocation

Debt allocation is another crucial component, specifying how debts incurred during the marriage will be distributed between the spouses.

Spousal Support Provisions

Spousal support provisions should be included to address whether one spouse will provide financial support to the other in the event of a divorce.

Estate Planning Considerations

Estate planning considerations can also be addressed in a prenuptial agreement, including provisions for inheritance and other estate-related matters.

To illustrate the key components of a prenuptial agreement template, consider the following table:

| Component | Description | Importance |

| Identification Section | States the names of the parties and their intention to marry | High |

| Property Division | Outlines how assets will be divided | High |

| Debt Allocation | Specifies how debts will be distributed | High |

| Spousal Support | Addresses financial support in the event of divorce | Medium |

| Estate Planning | Covers inheritance and estate-related matters | Medium |

Step-by-Step Guide to Completing Your Prenuptial Agreement Template

The process of completing a prenuptial agreement template involves several key steps that couples should understand to ensure their agreement is comprehensive and legally binding.

Gathering Financial Information

The first step in completing a prenuptial agreement template is gathering all relevant financial information. This includes details about assets, debts, income, and expenses. Both parties should be transparent about their financial situations to ensure the agreement is fair and equitable.

Full disclosure is crucial at this stage. Couples should compile documents such as bank statements, investment accounts, property deeds, and any outstanding loan or credit card statements.

Drafting the Agreement

Once all financial information is gathered, the next step is drafting the prenuptial agreement. This involves using the collected data to fill out the template, specifying how assets and debts will be divided in the event of a divorce. It’s essential to be thorough and precise when drafting the agreement to avoid potential disputes.

Couples should consider including provisions for property division, spousal support, and other financial matters. The agreement should be tailored to the couple’s specific needs and circumstances.

Review and Negotiation

After the initial draft is complete, both parties should review the agreement carefully. This step is critical to ensure that the document accurately reflects the couple’s intentions and that both parties are comfortable with the terms.

If necessary, couples can negotiate changes to the agreement. It’s advisable to have legal representation during this process to ensure that the agreement complies with state laws and protects both parties’ interests.

By following these steps, couples can create a comprehensive and legally sound prenuptial agreement that protects their assets and clarifies their financial responsibilities.

Common Mistakes to Avoid in Your Prenuptial Agreement

When drafting a prenuptial agreement, it’s crucial to avoid common pitfalls that can render the document invalid or unenforceable. A well-crafted prenuptial agreement can protect your assets and provide clarity in the event of a divorce. However, certain mistakes can undermine its effectiveness.

Unenforceable Provisions

One of the most significant mistakes is including provisions that are unenforceable or illegal. For instance, clauses that dictate child custody or support arrangements are generally not enforceable, as these decisions are typically made by family courts based on the best interests of the child at the time of the divorce. Including such provisions can lead to the entire agreement being challenged.

Inadequate Disclosure

Inadequate financial disclosure is another critical error. Both parties must provide full and fair disclosure of their financial situations, including assets, debts, and income. Failure to do so can result in the agreement being invalidated if it’s discovered that one party hid or misrepresented their financial status.

Poor Timing and Pressure

The timing of the prenuptial agreement is also crucial. Signing a prenuptial agreement under pressure or too close to the wedding date can lead to claims of duress or coercion, potentially invalidating the agreement. It’s essential to allow sufficient time for both parties to review and consider the agreement without feeling rushed.

| Common Mistake | Consequence | Prevention |

| Including unenforceable provisions | Entire agreement may be challenged | Review provisions for enforceability |

| Inadequate financial disclosure | Agreement may be invalidated | Ensure full and fair financial disclosure |

| Poor timing and pressure | Claims of duress or coercion | Allow sufficient time for review and consideration |

By avoiding these common mistakes, couples can create a prenuptial agreement that is both valid and effective, providing peace of mind and financial security for the future.

State-Specific Considerations for Prenuptial Agreements

Prenuptial agreements are not one-size-fits-all documents; they must be tailored to comply with state-specific laws. The laws governing prenuptial agreements vary significantly from state to state, making it crucial for couples to understand the specific requirements of their jurisdiction.

Community Property vs. Equitable Distribution States

One of the primary state-specific considerations is whether the state follows community property or equitable distribution principles. Community property states consider most property acquired during the marriage to be jointly owned, while equitable distribution states divide marital property in a fair manner, which may not necessarily be equal.

Community Property States: In states like California, Texas, and Arizona, community property laws apply, meaning that both spouses have equal rights to property acquired during the marriage.

Equitable Distribution States: States like New York, Florida, and New Jersey follow equitable distribution principles, where the division of marital property is based on fairness rather than equal division.

| State | Property Division Principle |

| California | Community Property |

| New York | Equitable Distribution |

| Texas | Community Property |

| Florida | Equitable Distribution |

Variations in State Requirements

Beyond property division principles, state laws vary in other requirements for prenuptial agreements, such as the need for full financial disclosure, the presence of witnesses, and notarization. For instance, some states require that both parties have independent legal counsel to ensure the agreement’s enforceability.

Edit

Full screen

state-specific prenuptial agreement considerations

Understanding these state-specific nuances is essential for drafting a prenuptial agreement that is both comprehensive and legally binding. Couples should consult with attorneys familiar with their state’s laws to ensure their agreement meets all necessary requirements.

Addressing Common Concerns About Prenuptial Agreements

As couples contemplate marriage, the idea of a prenuptial agreement can raise several concerns. While prenups are practical and can offer financial protection, they can also be a sensitive subject. Couples often worry about how to bring up the topic without jeopardizing their relationship.

Having the “Prenup Talk”

Initiating a conversation about a prenuptial agreement requires empathy and openness. It’s essential to approach the discussion with a focus on mutual understanding rather than confrontation. Couples should consider framing the conversation around their shared financial goals and how a prenup can help achieve them.

Balancing Protection and Trust

One of the primary concerns is that a prenuptial agreement might undermine the trust in a relationship. However, a well-structured prenup can actually strengthen a relationship by providing clarity on financial matters. As one expert notes, “A prenup is not about planning for divorce; it’s about building a strong financial foundation together.”

“A prenup is not about planning for divorce; it’s about building a strong financial foundation together.”

Ensuring Fairness for Both Parties

Fairness is a critical aspect of any prenuptial agreement. Both parties should have a clear understanding of their financial situation and the terms of the agreement. It’s advisable to work with legal professionals to ensure that the prenup is equitable and compliant with state laws

By addressing these common concerns and approaching the topic with sensitivity, couples can create a prenuptial agreement that protects their interests while nurturing their relationship.

Alternatives to Traditional Prenuptial Agreements

Couples seeking to safeguard their financial futures have alternatives to traditional prenuptial agreements. While prenuptial agreements are a well-known option, other legal tools can provide similar protections and benefits.

One such alternative is a postnuptial agreement, which serves a similar purpose to a prenuptial agreement but is entered into after marriage.

Postnuptial Agreements

A postnuptial agreement is a legal contract between spouses that outlines the division of assets, debts, and other financial matters in the event of a divorce or separation. It can be particularly useful for couples who experience significant changes in their financial situation after marriage.

Trust Arrangements

Another alternative is establishing trust arrangements. Trusts can be used to manage and protect assets for the benefit of both spouses or for specific family members. They offer flexibility and can be tailored to meet the unique needs of the couple.

Conclusion

A prenuptial agreement template is essential for protecting your assets and ensuring financial security. A well-crafted prenuptial agreement provides clarity and peace of mind for couples entering into marriage.

Understanding the importance of a prenuptial agreement and following the outlined steps helps create a comprehensive agreement. Using a reliable prenuptial agreement template ensures your agreement is valid and enforceable.

In conclusion, approaching the creation of a prenuptial agreement with care is crucial. This helps secure your financial future.

Explore your options for creating a prenuptial agreement today using a prenuptial agreement template.

FAQ

What is a prenuptial agreement template?

A prenuptial agreement template is a document that outlines the financial responsibilities and asset distribution in the event of a divorce, helping couples protect their assets.

Are prenuptial agreements legally binding in the United States?

Yes, prenuptial agreements are generally enforceable in the United States, provided they meet certain legal requirements, such as full financial disclosure and voluntary execution.

Who should consider having a prenuptial agreement?

High net worth individuals, business owners and entrepreneurs, and those entering into second marriages may particularly benefit from having a prenuptial agreement in place to protect their assets.

What are the essential components of a prenuptial agreement template?

Essential components include identification and declaration, property and asset division, debt allocation, spousal support provisions, and estate planning considerations.

How do I complete a prenuptial agreement template?

Completing a prenuptial agreement template involves gathering financial information, drafting the agreement, and reviewing and negotiating the terms.

What are some common mistakes to avoid when creating a prenuptial agreement?

Common mistakes to avoid include including unenforceable provisions, inadequate financial disclosure, and poor timing that may lead to pressure.

How do state laws affect prenuptial agreements?

State laws can affect prenuptial agreements, with differences between community property and equitable distribution states, as well as variations in state requirements.

Can I use a prenuptial agreement template for a postnuptial agreement?

While a prenuptial agreement template is designed for couples before marriage, some provisions may be applicable to postnuptial agreements, which are agreements made after marriage.

How can I ensure fairness in a prenuptial agreement?

Ensuring fairness in a prenuptial agreement involves open discussion, full financial disclosure, and a willingness to negotiate terms that are reasonable and acceptable to both parties.